Our Approach

Our investment team uses a disciplined, bottom-up, low P/E approach to investing. We invest in companies with low P/Es that we feel exhibit strong fundamentals and historical earnings growth, and that our analysis indicates will persist over the long run. We believe that cheap stocks have better downside protection given their modest valuations relative to the respective benchmark.

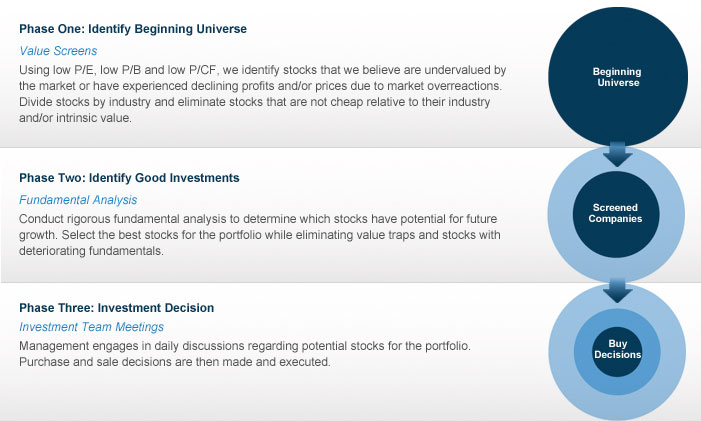

THE SELECTION PROCESS

Sell Discipline

Our sell discipline is as systematic as our selection process, and benefits from our constant evaluation of the stocks in our funds, both relative to themselves and their industries.

We will sell or trim positions when:

A stock's valuation rises above the market.

A stock's valuation exceeds that of its industry.

A stock experiences weak or declining price momentum and/or deteriorating fundamentals.

Risk Management

We believe true risk is the potential for a permanent loss of capital assuming an appropriate time horizon. Volatility is not true risk. We attempt to mitigate true risk in three ways: (1) Valuation risk-don't overpay for a stock. (2) Earnings power risk-earnings power is temporarily and not structurally impacted. (3) Balance sheet/financial risk-make sure the balance sheet is strong enough to weather market volatility.